Licensing There are no licensing requirements for this career at time of publication. How do I get there? A combination of the following qualifications would be helpful in gaining employment in the property and casualty insurance industry.Ĭollege/University A college diploma or university degree in engineering science, commerce, business management and judicial studies are acceptable for entry into the profession, though those who have earned a degree or specialization in risk management are at a distinct advantage. If you answered yes to these statements, then a career as a risk manager might be the perfect fit!

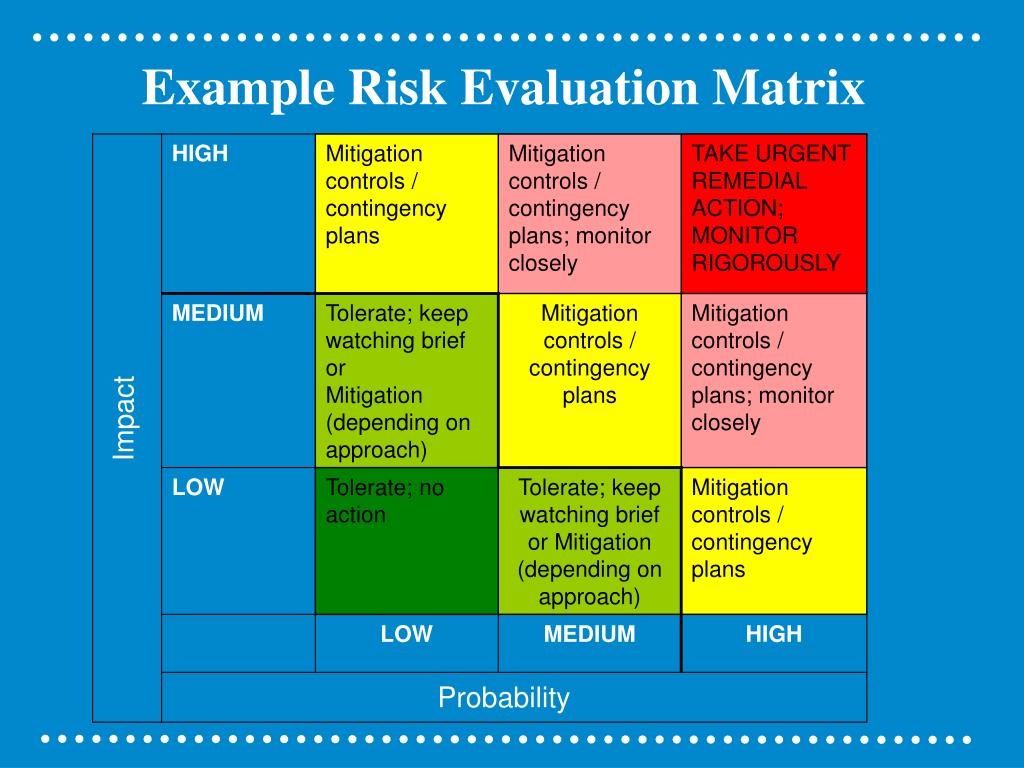

You have strong communication and interpersonal skills.Your current program of study requires the ability to communicate complex ideas, critical thinking, time-management and organization.You are currently enrolled in a general arts, education, humanities or a business program at the post-secondary level.Doing so can have an impact on the amount of funding allocated to risk management activities, and may also convince management to avoid certain strategic alternatives due to their risk profiles.Do the following statements accurately describe you? Present the risk profile and risk mitigation plans to the board of directors at regular intervalsĪ more successful risk manager should be able to estimate the financial impact of certain risks if they come to pass, and convey these projections to senior management. Maintain records relating to all incidents and insurance claimsĮvaluate new risk management techniques and recommend them to management as appropriate Manage relations with all insurance providers Monitor the probability of loss from all types of risksĮnsure that the company is in compliance with all government regulations relating to its insurance coverageĭesign methods for the mitigation of losses, such as through outsourcing of operations, changes to work instructions, or the procurement of insurance

In more detail, the job description of the risk manager encompasses the following:ĭetermine the nature of all risks to which the company is subjected, and monitor operations to spot changes in these risks The risk manager should also be cognizant of risk issues that have impacted other companies in the industry, and explore whether those issues could impact the company at a later date. He or she should also have a detailed knowledge of prior accidents, lawsuits, and claims, and the reasons for those incidents. In general, the risk manager should be thoroughly versed in the industry within which the company operates, as well as the facilities, processes, and products of the company. Thus, the risk manager position should be considered a mid-level management position. The position usually reports to the chief financial officer, but may also work closely with many parts of the company, including engineering, human resources, legal and accounting, production, safety and health, and security. The risk manager position is responsible for the monitoring and mitigation of all risks within a company.

0 kommentar(er)

0 kommentar(er)